By Burnett Munthali

FDH Bank Plc has issued a revised trading statement for the financial year ending 31st December 2024, providing a significant update on its profit expectations. The revision comes as part of the bank’s compliance with the Malawi Stock Exchange Listing Requirements, which mandate listed companies to publish trading statements when financial outcomes deviate by at least 20% from the previous period or when a previously published trading statement becomes obsolete.

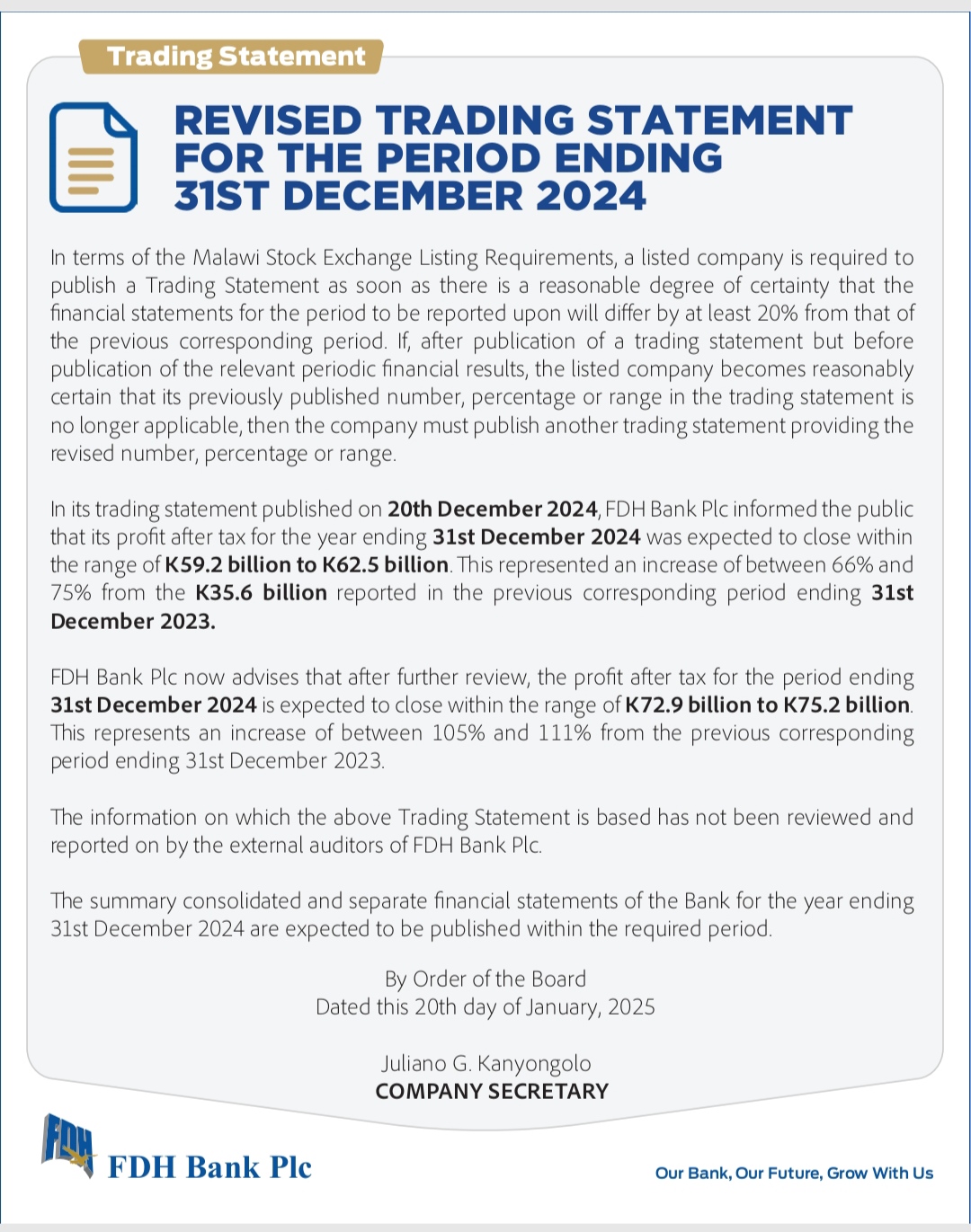

On 20th December 2024, FDH Bank Plc released a trading statement indicating that its profit after tax for the financial year 2024 was expected to fall within the range of MWK 59.2 billion to MWK 62.5 billion. This represented an impressive growth of between 66% and 75% compared to the MWK 35.6 billion reported in the financial year ending 31st December 2023.

The initial projections showcased FDH Bank Plc’s continued resilience and strong financial performance, signaling a significant boost in profitability and solidifying the bank’s reputation as a key player in Malawi’s banking sector.

Following a further review of the bank’s financial performance, FDH Bank Plc has now revised its profit expectations. According to the updated trading statement, the profit after tax for the year ending 31st December 2024 is projected to be in the range of MWK 72.9 billion to MWK 75.2 billion. This marks an extraordinary increase of between 105% and 111% from the MWK 35.6 billion reported in the previous year.

The revised figures underline an even stronger financial position than initially anticipated. This substantial growth can be attributed to strategic initiatives, increased operational efficiency, and favorable market conditions that FDH Bank Plc leveraged throughout the year.

The upward revision of the profit forecast is a testament to FDH Bank Plc’s robust financial strategies and its ability to adapt to dynamic market environments. The significant jump in profitability reflects the bank’s strong focus on driving revenue growth, managing costs effectively, and delivering value to shareholders.

For stakeholders, including investors, this update is an indication of the bank’s impressive trajectory of growth and its commitment to transparency. By revising its trading statement, FDH Bank Plc has reinforced its dedication to providing accurate and timely information to the market in line with regulatory requirements.

The revised trading statement emphasizes that the information on which these projections are based has not yet been reviewed or reported on by the bank’s external auditors. However, FDH Bank Plc has assured stakeholders that the summary consolidated and separate financial statements for the year ending 31st December 2024 will be published within the required period.

This remarkable financial performance, with projected profits more than doubling year-on-year, reflects the success of FDH Bank Plc’s growth strategies and its resilience in navigating challenges in the banking sector. The revised profit forecast is expected to instill greater confidence among investors and customers, further solidifying the bank’s position as a leader in Malawi’s financial industry.

As FDH Bank Plc continues to deliver strong results, it is clear that the bank’s strategic focus on innovation, operational excellence, and customer-centric services is yielding tangible outcomes. With the publication of the final financial statements on the horizon, stakeholders eagerly await confirmation of the impressive growth outlined in the revised trading statement.

By Order of the Board, the revised statement was officially issued on 20th January 2025, under the signature of the company secretary, Mr. Juliano G. Kanyongolo. This milestone underscores FDH Bank Plc’s commitment to fostering transparency, growth, and sustained success in Malawi’s financial sector.