By Draxon Maloya

Private sector economic players have expressed concerns over the country’s recent economic performance, particularly the Reserve Bank of Malawi’s report that the country has only two months’ worth of import cover, falling short of the required three-month threshold.

This comes as the country approaches general elections, amid a turbulent economic environment.

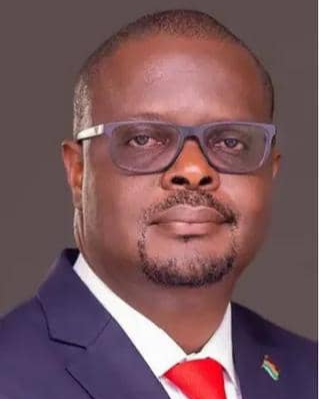

Executive Director of Formula One Customs and Clearing Solutions, Kenneth Gondwe, highlighted the uncertainty surrounding the post-election period.

“After the election, it is not known what will happen because even the government will need to comply with the International Monetary Fund (IMF) recommendations, which, by the look of things, spells doom economically,” said Gondwe.

In a seperate interview, commenting on food inflation local maize trader Yosefe ‘Bolamoyo’ Misinde echoed Gondwe’s concerns, forecasting that maize prices could almost double by the end of September.

“Currently, a 50kg bag of maize is trading as high as K70,000, and we expect it to hit K120,000 by the end of September,” Misinde said.

Making his contribution during the Monetary Policy Forum plenary, Raiply Malawi Limited’s Marketing Manager, Prateesh Babu, raised concerns about the insufficient import cover, citing fiscal data that showed a significant deficit in the first quarter of the 2025/26 financial year.

“Fiscal data presented during this forum painted a challenging picture, with first-quarter figures showing revenue at K1.18 trillion against expenditure of K1.84 trillion, resulting in a deficit of K661.96 billion,” Babu observed.

However, the Monetary Policy Committee (MPC) of the Central Bank warned that while inflation has eased, there are still turbulence ahead, and prices of essential goods and services are expected to rise.

MPC Chairperson Chakudza Linje stated that fiscal pressures, if not addressed, risk undermining progress made on monetary policy and could keep inflation elevated for longer.

“The Central Bank attributed the high inflation to several risks, including limited fiscal consolidation, rising food prices and the increased demand for foreign exchange outstripping supply,” cautions Chakudza Linje.

To achieve the short and long term solutions, the forum discussed strategies to bridge the fiscal gap, stabilize food prices, and improve foreign exchange supply.