By Suleman Chitera

Serious governance and fiduciary concerns have engulfed the proposed acquisition of the Amaryllis Hotel in Blantyre by the Public Service Pension Trust Fund (PSPTF), after the purchase price reportedly surged from K47 billion to as much as K147 billion within a year.

The transaction, intended to be financed using pension contributions from retired and serving public servants, is now under intense public scrutiny over transparency, valuation integrity and compliance with regulatory advice.

Price Escalation Raises Red Flags

Records indicate that in November 2025, the hotel was earmarked for purchase at K47 billion. However, the figure is now reported to have risen to between K128 billion and K147 billion — effectively tripling the initial valuation in under twelve months.

The magnitude of the upward revision has triggered alarm among governance advocates and pension contributors, who are questioning the basis for the revaluation, the due diligence process undertaken, and whether an independent property assessment was conducted to justify the dramatic increase.

For a pension fund whose primary mandate is capital preservation and sustainable returns for beneficiaries, such volatility in acquisition cost raises serious concerns about prudence, investment discipline and risk management.

Approvals Under the Spotlight

Documents circulating on social media — purportedly bearing endorsements from the Anti-Corruption Bureau (ACB) and the Attorney General’s office — suggest that legal and anti-corruption clearances were granted for the transaction.

However, civil society actors argue that the mere existence of approvals does not substitute for full transparency. Questions remain over whether the approvals were conditional, whether all regulatory thresholds were met, and whether material information was disclosed to oversight bodies before consent was given.

Civil Society Demands Suspension

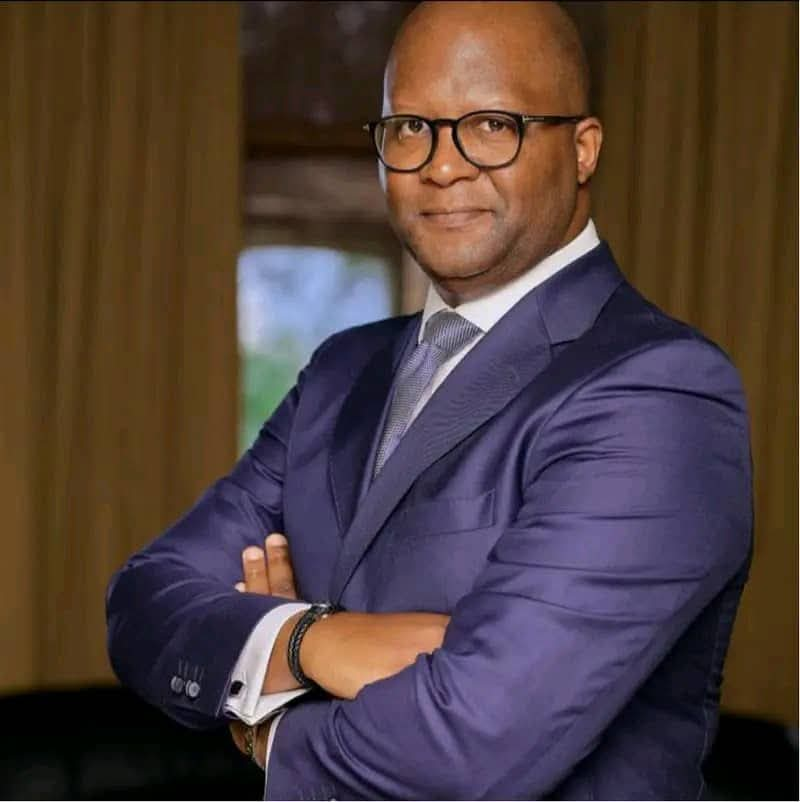

Willy Kambwandira, Executive Director of the Centre for Social Accountability and Transparency (CSAT), described the transaction as deeply troubling, particularly given prior resistance from key institutions.

Kambwandira noted that both the Reserve Bank of Malawi and the Malawi Law Society had earlier advised against proceeding with the acquisition.

“The sequence of events raises procedural and governance concerns,” Kambwandira said, adding that pension funds represent deferred earnings of workers and must be managed with the highest fiduciary standards.

CSAT has since called for an immediate suspension of the deal pending an independent investigation into valuation methods, procurement procedures and compliance with pension investment regulations.

Fiduciary Duty and Pension Risk

At the core of the controversy is the fiduciary obligation owed by PSPTF trustees to pension beneficiaries. Pension funds are legally and ethically bound to prioritize long-term stability, diversified investment strategies and risk-adjusted returns.

Critics argue that investing heavily in a single hospitality asset — particularly in an economy facing macroeconomic volatility — may expose pensioners’ savings to concentrated sectoral risk.

Hospitality investments are sensitive to tourism flows, foreign exchange stability and overall economic performance. Without transparent feasibility studies and cash flow projections, stakeholders say it is difficult to determine whether the projected return justifies the acquisition price.

Board Puts Deal on Hold

Amid mounting pressure, PSPTF Board Chairperson James Daile Kumwenda has announced that the acquisition process has been temporarily halted, stating that the transaction “appears unfeasible” in its current form.

The suspension signals acknowledgment of the growing backlash but does not fully resolve outstanding questions regarding how the price escalated so sharply and who authorized each stage of the process.

Calls for Full Disclosure

Governance advocates are now demanding:

- Publication of the independent valuation reports

- Disclosure of board resolutions approving the revised price

- Clarification on regulatory compliance with pension investment guidelines

- A forensic audit of the transaction process

For many pension contributors, the issue transcends the hotel itself. It touches on trust in public financial management systems and the safeguarding of retirement savings.

Until full disclosure is made, the Amaryllis Hotel deal is likely to remain a flashpoint in Malawi’s broader debate on accountability, institutional integrity and the protection of public funds.