By Draxon Maloya

The Malawi kwacha has suffered a 2.3% depreciation against the US dollar in the first six months of 2024, fueled by rising inflation, increased interest rates, and foreign exchange shortages.

This economic downturn has heightened macroeconomic risks, piling pressure on the financial stability of the country.

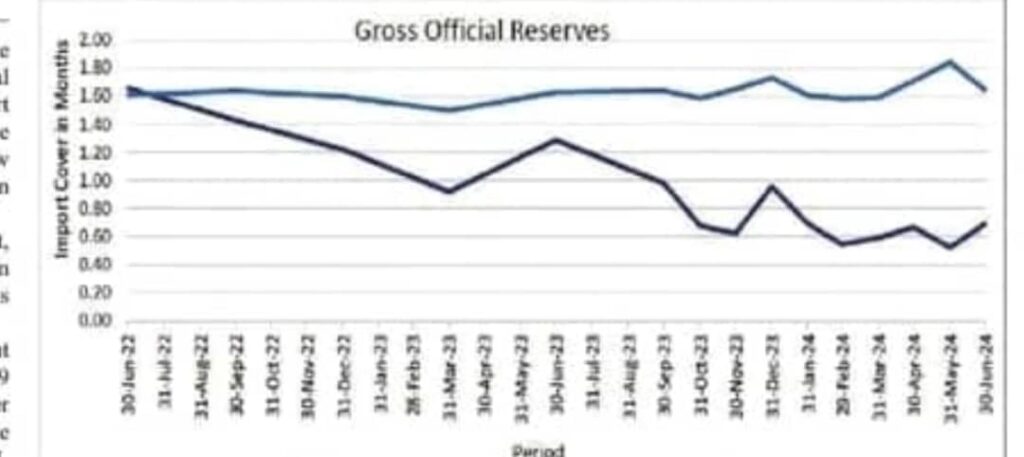

According to the Reserve Bank of Malawi’s (RBM) recent Financial Stability Report, inflation rates have surged, while higher interest rates have strained the economic environment. The report also highlights vulnerabilities in the external sector, exacerbated by the kwacha’s depreciation.

During the period under review, the kwacha lost 3.12% of its value against the US dollar, closing the first half at K1,748.01 to a dollar. This translates to a loss of K52.05 in value.

Despite these challenges, Malawi’s financial markets have shown resilience, although they continue to face stress due to ongoing economic pressures.

One of the bureau economic analysts observed the situation saying, the Kwacha has lost value against all major trading currencies.

“They have observed that there is a big gap (spread) between the TT rate and the indicative cash rate in Bureaus which put inflationary pressure on the local currency,” he said.

He further highlighted, the Monetary Policy reacted by increasing the interest policy rate to control some of the pressure on the Kwacha

Former Reserve Bank of Malawi Governor Dalitso Kabambe painted a grim picture of the economy, stating it is “down on its knees” with no signs of recovery in sight.

“We stand at a critical juncture, burdened by challenges that present opportunities for renewal and economic transformation,” Kabambe said.

“The struggling kwacha, rising inflation, and escalating cost of living are not mere figures – they reflect the live experiences of Malawians striving for a better life,” He added.

Kabambe emphasized the need for effective solutions grounded in economic pragmatism, moving beyond rhetoric and media spectacles.