The Deposit Insurance Corporation (DIC) has assured bank depositors money security in case of other eventualities such as when the bank develops a fault.

This was revealed during the official launch of the deposit insurance corporation at Bingu International Convention Centre (BICC) in Lilongwe on Thursday evening.

The Board Chairperson of Deposit Insurance Corporation Dr. Gabriela Chiutsi said the institution is geared to help money depositors to claim their money back from the insurance if a bank has developed a fault or has been shut down.

“The launch of the Deposit Insurance Corporation in Malawi is a positive development for the bank sector as it will help people to keep money at the bank knowing they have security assurance at the end of the day.

“It will also help people with less than one million Kwacha to claim back their money if the bank has developed a fault or has been shut down since about 93 per cent of people fall under this corporation,” said Chiutsi.

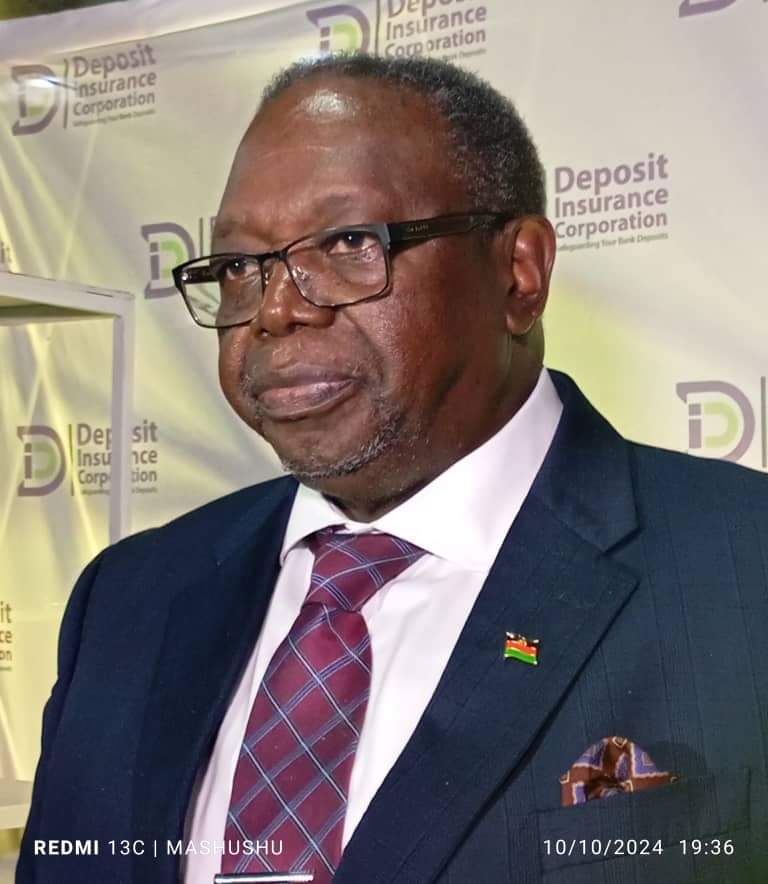

Governor of Reserve Bank of Malawi, Wilson Toninga Banda said Discount Insurance Corporation is one of the institutions that has been lacking since time immemorial, and their coming will help in developing financial achievements.

“This is internationally recognised in most of the developed countries such as the United States of America USA, United Kingdom UK and others hence its official operations in Malawi will greatly help banks and its customers to benefit symbiotically,” said Banda.

Banda also added that banks in Malawi are very well capitalised with good performance and quality which will ensure the country benefits profitably.

The World Bank country manager for Malawi, Filas Raad, expressed gratitude towards the Reserve Bank of Malawi for its collaborative support in establishing a deposit insurance corporation through the government by preparing a regal, Regulatory and operational framework.

“DIC is very important for the country as it will help to promote financial stability, financial inclusivity and also promote small depositors to have comfort and relief as their money is well secured in case of any bank emergencies,” he said.