By Burnett Munthali

Currency devaluation, a strategy sometimes employed by governments to stimulate exports and balance trade deficits, can lead to a host of economic challenges that disproportionately affect the most vulnerable segments of society. In the context of Malawi, recent devaluations have raised concerns that many Malawians may face increased poverty levels, exacerbating an already precarious economic situation.

One of the most immediate impacts of currency devaluation is a significant rise in the cost of living. As the local currency loses value, the prices of imported goods—including essential items such as food, fuel, and medical supplies—skyrocket. This inflationary pressure hits low- and middle-income families the hardest, as they often spend a larger proportion of their income on these necessities. The result is a dramatic decline in purchasing power, forcing families to make difficult choices about what to buy or whether to forgo essential goods altogether.

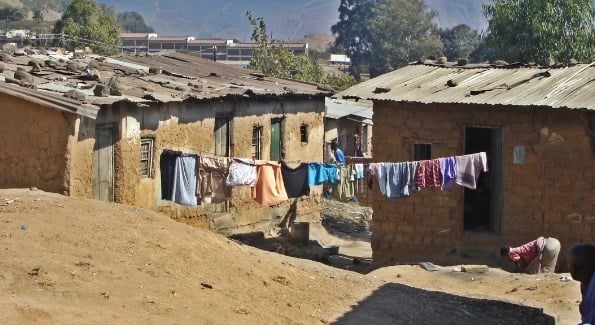

With the cost of living rising due to inflation and reduced purchasing power, more Malawians are pushed into poverty. The World Bank has noted that a significant percentage of the population already lives below the poverty line, and devaluation only serves to deepen this crisis. Families who were previously managing to get by may find themselves struggling to meet even their basic needs, leading to a surge in poverty rates across the country.

Devaluation erodes the value of savings held in the local currency, making it increasingly difficult for individuals and families to save for the future. As inflation rises, the real value of savings diminishes, discouraging Malawians from saving altogether. This lack of savings can stifle investment in education, healthcare, and entrepreneurship, further perpetuating the cycle of poverty.

Malawi, like many developing nations, carries a significant amount of foreign debt. Devaluing the local currency increases the cost of servicing this debt, as repayments become more expensive in local currency terms. Consequently, the government may be forced to allocate a larger portion of its budget to debt repayment rather than investing in crucial areas such as infrastructure, health, and education, which are essential for reducing poverty and fostering economic growth.

As poverty rises and living conditions worsen, social unrest becomes more likely. Malawians who are struggling to make ends meet may become frustrated with the government’s inability to manage the economy effectively. Protests and demonstrations can arise from a populace that feels disenfranchised and ignored, further destabilizing the country and potentially leading to violence and civil unrest.

The compounded effects of devaluation create long-term economic consequences that can be difficult to reverse. Increased poverty leads to lower levels of education and health, which in turn affects the workforce’s productivity. A less educated workforce hampers economic growth and innovation, perpetuating a cycle of poverty that can take generations to break.

In summary, the devaluation of the Malawian currency threatens to make many citizens poorer than ever before. With rising costs of living, increased poverty rates, and diminished savings, the negative repercussions of devaluation can be profound and far-reaching. It is crucial for policymakers to consider the long-term implications of their economic decisions and explore more sustainable strategies for economic growth that protect the most vulnerable members of society. Only through thoughtful economic management can Malawi hope to escape the cycle of poverty and build a brighter future for its citizens.

- RBM pushes banks towards private sector A’s Government declines K500 Billion in borrowing

- MCTU Pushes for K250,000 Minimum Wage as ECAM Urges Gradual Adjustment

- Karonga United Reserves Crowned Northern Region U23 National Bank Champions

- Two Empty Bottles and a Priceless Man: The Character of Alexious Kamangira

- FGRF Reaches 100,000 Families with Ramadan Food Relief Across Malawi