Malawi Revenue Authority (MRA) says it is annually losing an estimated K100 billion to tax evasion.

MRA commissioner general John Biziwick disclosed this in Mangochi yesterday during a 2023/24 New Tax Measures Media Training of members of the Association of Business Journalists.

He said already, the public tax collector is dealing with tax evasion cases in excess of K60 billion.

Biziwick said: “When we look at the figures which are coming from investigations we undertake now and then, they are huge. This is tax evasion from under-declaring of imports, over invoicing of exports but also for taxpayers who have not met value added tax, income tax and other tax obligations.

“All this money ends up as foreign exchange somewhere. No wonder some of the forex challenges we are having.”

The commissioner general said that to curb the malpractice, MRA is putting up systems.

He said: “Beyond that, we are looking at widening the tax net by bringing in new initiatives and broadening tax. One major initiative we shall benefit from is the operationalisation of Msonkho Online. We shall start with large taxpayers and we hope to roll up by September this year.”

In December last year, Public Accounts Committee (PAC) of Parliament asked MRA to enhance the fight against tax evasion to ensure that lost revenue is redirected into public coffers.

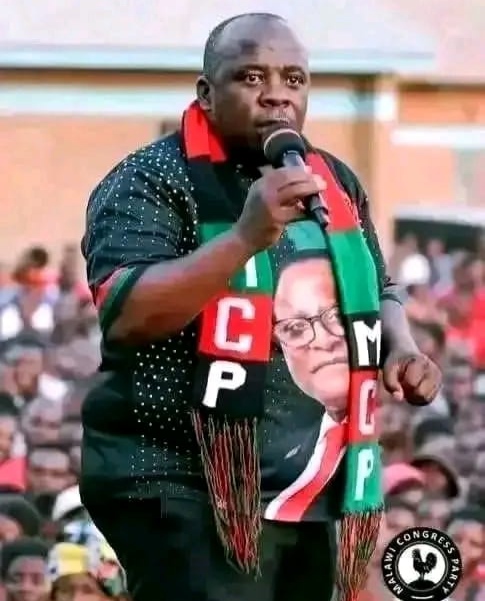

Speaking when MRA officials appeared before the committee at Parliament Building in Lilongwe, PAC chairperson Mark Botomani expressed concern over porous borders which he said have led to the flourishing of cross-border smuggling.

He said MRA should put offices in strategic places, mount ad hoc roadblocks and patrol routes that people use to smuggle goods into and outside the country.

Botomani further said if the country can successfully fight tax evasion, government would generate more revenue to support various social services.

Meanwhile, government ministries, departments and agencies (MDAs) owe MRA K9.8 billion in tax arrears, which Biziwick said has risen due to system issues between Accountant General (AG) and RBM.

“We were assured that by April 30, these amounts will be transferred to MRA. We have since engaged RBM, AG office and Treasury to ensure that this does not continue and that we will be paid. We are hoping this to be done this week or next week.

“But in addition, some of the arrears are arising because officers processing these with various MDAs are not conversant with the procedures.”

In the 2022/23 financial year, MRA registered a surplus of K1.4 billion having collected K1.5 trillion from a projected K1.5 trillion.

In the 2023/24 financial year, MRA is projected to collect K2.111 trillion, representing a growth of 37 percent from the previous year’s collection