National Bank of Malawi (NBM) plc and NBS Bank plc have asked the court to remove them as defendants in a case where the K105 billion financing for the Salima-Lilongwe Water Project has stirred controversy.

Parliament approved the two local commercial banks to collectively extend the loan to Khato Civils, but Forum for National Development (FND) obtained an injunction to stop the banks from releasing the funds.

In the case, the banks were defendants alongside the Attorney General (AG) while FND is the petitioner.

Meanwhile, when the High Court of Malawi Commercial Division in Blantyre convened yesterday, lawyer for FND Edgar Kachere, asked for an adjournment as the defence served them the application late.

But the defendants objected to the adjournment, citing urgency of the matter.

In his ruling on the matter, presiding Judge Ken Manda allowed the adjournment to May 30 2023 on grounds that the claimant did not have two days, as permitted by the law, from the time he was served the latest documents on Friday.

Issues in the fresh documents include applications by National Bank and NBS Bank to be removed as defendants while asking the court to discharge the injunction FND obtained.

The judge said his initial direction was to have a pre-hearing within 14 days to ascertain whether the case at hand was a commercial matter. He said it was in this regard that the matter was set down for yesterday.

Manda further observed that NBM and NBS Bank also proceeded to file an application last Friday to be discharged as parties to the action.

He said: “What is clear from the above facts is that my direction that there should be an initial presentation as to whether this is commercial matter or not has been overtaken by events in that the parties would now want this court to deal with the substantive issues which is whether this injunction should be maintained or discharged.”

During hearing of the matter in the judge’s chamber, AG Thabo Chakaka Nyirenda also asked the court to grant a stay on the FND injunction, but the judge asked him to make a formal application.

The banks may proceed to disburse the loans should the court vacate its order.

When the court reconvenes on May 30, aside what may happen between now and then as the AG makes the application for stay of the injunction, the defendants would be arguing to have the FND injunction dismissed to allow the banks release the money. FND would be fighting to have the injunction sustained while making its case on why the two banks should not loan Khato Civils as approved by Parliament in March.

The two banks are being represented by lawyers Lester Mwantisi and Tisume Mwaungulu while Chancy Gondwe is representing Khato Civils.

Earlier yesterday, the court threw out journalists through a communication from a clerk purportedly because the proceedings were being heard as a chamber matter.

Ordinarily, journalists in Malawi have been covering chamber matters without seeking permission as long as they produce their identity cards and there is enough space.

In the case, FND national coordinator Fryson Chodzi is arguing that Khato Civils was supposed to identify a financier and not involve the Malawi Government to borrow on its behalf.

He is on record to have argued that Khato Civils identified a financier, Quay Energy Corp, to the tune of K25 billion, but no explanation was given on what happened to the financier.

On the other hand, Khato Civils, through Gondwe, are arguing that the Government of Malawi through the National Assembly passed the NBS Bank plc and National Bank of Malawi plc (Lake Malawi Water Supply Project) Loan Authorisation Bill, 2023.

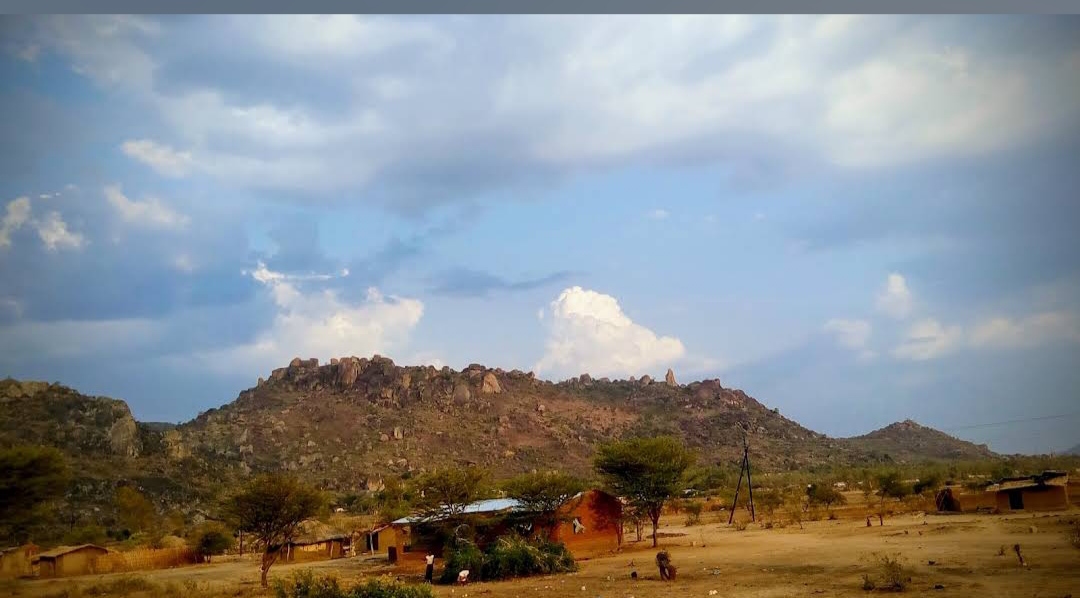

They contend the Bil l was passed into law on April 6 2023, effectively authorising the government to borrow from the two banks to finance the abstraction and treatment of water from Lake Malawi at Lifuwu in Salima and transportation of the treated water to Lilongwe City.

The Salima-Lilongwe Water Project was initiated in 2015 and was supposed to be completed in 2018/19, but it has faced a number of challenges, including funding