A comprehensive new report reveals that finance teams worldwide are at a critical juncture, with just five years to adapt to rapidly changing demands – but Africa is ahead of the game.

Thursday, 5 September 2024: Finance teams have just five years to transform or risk becoming irrelevant, according to a new report by ACCA (the Association of Chartered Certified Accountants) and Chartered Accountants ANZ in association with PwC. The report, Finance Evolution: Thriving in the Next Decade, stresses the vital role finance teams play in building sustainable businesses and urges CFOs and finance leaders to take immediate action.

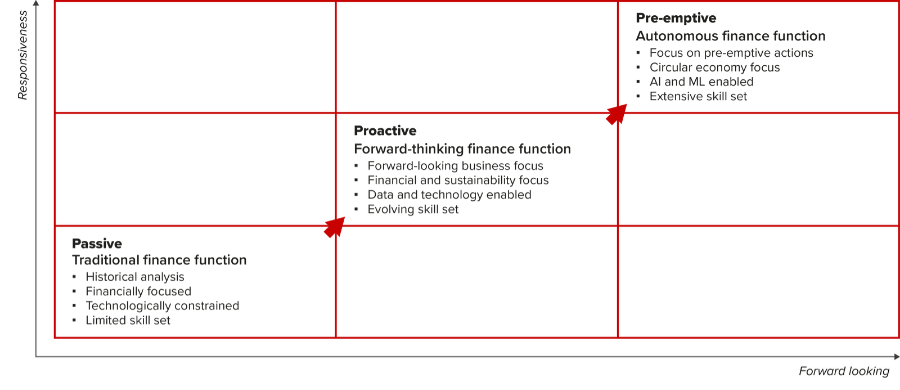

Drawing on insights from over 150 finance professionals and 2,300 survey responses worldwide, the report shows that businesses now demand a broader skill set from their finance teams, as retrospective reporting and traditional approaches to planning and forecasting alone no longer meet key decision-makers’ needs. Being pre-emptive is the order of the day.

Jamil Ampomah, director – Africa at ACCA said: ‘71% of Africa respondents said that their organisation had a vision, either fully or partially, for the finance function which looked three to five years hence. This is the greatest proportion of respondents to this question, which compares favourably to 66% globally.’

The three most significant barriers to enhancing the role of the finance function in the Africa region were:

- a lack of understanding as to the areas where finance can add business value

- not being able to address inconsistencies between long-term and short-term priorities; and

- a lack of funds to invest in people.

Other findings from Africa revealed that as the balance of effort in the finance function changes, 85% of the survey respondents in the Africa saw an increase in compliance and control as the most significant however increases were expected in all areas of the function.

The autonomous function opens up new roles within finance although, at the present time, the survey respondents indicated a reluctance to embrace some of these. The Africa respondents indicated that 25% already had recruited a data analyst, 9% a sustainability controller and 7% an algorithm auditor.

Globally, the report revealed that finance teams must embrace technologies like artificial intelligence, machine learning and data analytics, to enhance decision-making and operational efficiency. These technologies help finance teams reduce manual tasks, boost efficiency, and be recognised as key drivers of growth rather than merely number crunchers. The role of finance has also expanded to include leadership on long-term value creation including sustainability issues.

However, the report also emphasises that as finance teams undergo this transformation, the importance of ethics must remain at the forefront. With the increasing reliance on technology and data, maintaining a strong ethical foundation is crucial to building and sustaining trust.

Helen Brand OBE, Chief Executive of ACCA, said, ‘For finance teams to stay relevant, they need to look ahead. CFOs and finance leaders must ensure they are measuring both the long-term and short-term goals of sustainable business models effectively. The role of the CFO is fast evolving beyond finance to encompass wider value creation and management.’

Ainslie van Onselen, Chief Executive Officer of Chartered Accountants ANZ, stated, ‘While the arrival of new technology presents exciting opportunities to radically transform and improve the way we work, the one thing that must never change is our profession’s strong ethical standing. While we upskill and future proof our technology capabilities, we must also remain firmly focused on the ethical role that financial professionals – especially Chartered Accountants – must play.’

Moreover, the report highlights significant skill deficits in the areas of digital, data, and sustainability. Addressing these gaps is essential for finance teams to lead effectively in the next decade.

Simon Seymour, Partner at PwC, noted, ‘Respondents highlighted their biggest skills gaps as digital skills, data skills and sustainability skills. A critical question for the industry, as a whole, is why these skills gaps remain so pronounced and how far organisations should go to own the skills agenda, and not just rely on traditional training.’

The report is a clear call for action: finance teams must embrace new technologies, develop critical skills in digital, data, and sustainability, and uphold the highest ethical standards to ensure they remain integral to their organisations’ success in the years to come.