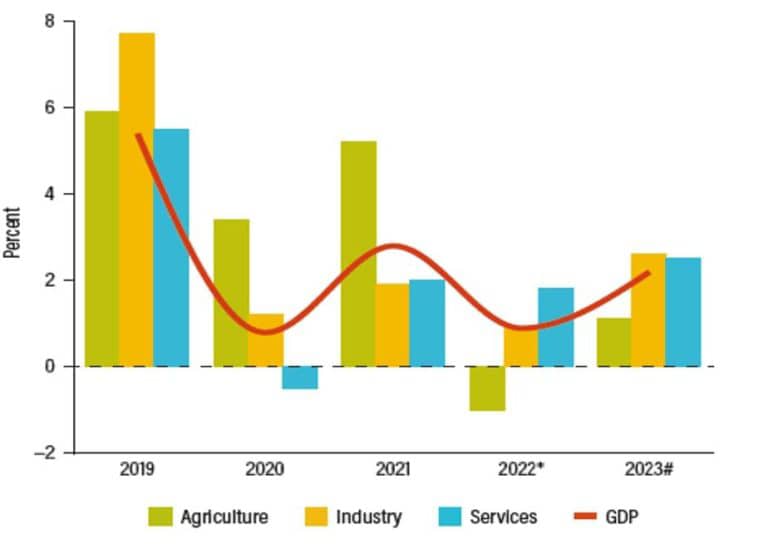

The World Bank’s latest Malawi Economic Monitor has delivered a sobering assessment of the country’s economic trajectory, revising the 2025 growth outlook downward to just 2.0%.

This downgrade represents more than a shift in figures—it reflects a deepening concern about Malawi’s macroeconomic stability and the slow pace of reforms necessary to stimulate meaningful development.

Among the key factors cited for the economic slump are high inflation, persistent shortages of foreign exchange, and widespread food insecurity that continues to undermine household resilience.

The report warns that without decisive and urgent policy interventions, Malawi risks sliding further into a prolonged state of economic stagnation, with consequences that will reverberate across generations.

What we are witnessing is not a sudden collapse, but a slow-burning economic crisis—one marked by structural weaknesses, fiscal indiscipline, and poor coordination between policy and implementation.

While some external shocks—such as climate-induced agricultural disruptions and global commodity price volatility—have undoubtedly played a role, much of the burden rests on domestic policy failure and missed opportunities.

Successive budgets have leaned heavily on borrowing and consumption, rather than building production capacity or stimulating exports that can earn the foreign exchange Malawi desperately needs.

Meanwhile, government spending continues to outpace revenue collection, and despite rhetoric on austerity and reform, luxury expenditures and leakages through procurement abuse remain a persistent concern.

Inflation, which has eroded purchasing power for millions, is not just a technical number on a graph—it is a lived experience for families struggling to afford basic necessities like maize, cooking oil, and school fees.

The Kwacha’s weakness has also amplified these struggles, with import-dependent sectors—particularly fuel and medicine—feeling the strain of costly foreign currency procurement.

The crisis in agriculture, which remains the backbone of Malawi’s economy, is central to this debate. With erratic rains and dwindling fertilizer access, smallholder farmers—the majority of the population—are finding it harder to survive, let alone thrive.

At the same time, efforts to diversify into agro-processing, manufacturing, and industrial value chains have remained largely aspirational, trapped in policy papers with little political will to translate plans into action.

What’s also evident is a growing sense of disillusionment among citizens. Promises of mega farms, digital transformation, and youth employment have been slow to materialize, further eroding public trust in government institutions.

So where does Malawi go from here?

One pathway to recovery lies in stabilizing the macroeconomic environment—tightening fiscal discipline, realigning priorities toward productive sectors, and ensuring that public resources are not lost to corruption.

Another lies in rethinking how agriculture is supported—from input subsidies that often benefit the few, to smart investments in irrigation, extension services, and climate-resilient farming.

Moreover, meaningful progress will require bold reforms in the energy sector, financial markets, and land administration—areas that can unlock private sector investment and job creation.

Debt relief may offer short-term breathing room, but without deeper structural reforms, it will only delay the inevitable reckoning.

This is not a time for business-as-usual. Malawi must move from crisis management to proactive economic transformation.

The 2.0% growth forecast is not just a number—it’s a warning.

A warning that unless we confront the hard truths about our economy and our governance, Malawi risks condemning another generation to poverty, underdevelopment, and unrealized potential.

It is time for our leaders—not just in government, but across all sectors—to rise to the occasion with courage, discipline, and a genuine commitment to long-term national development.

The clock is ticking.