By Burnett Munthali

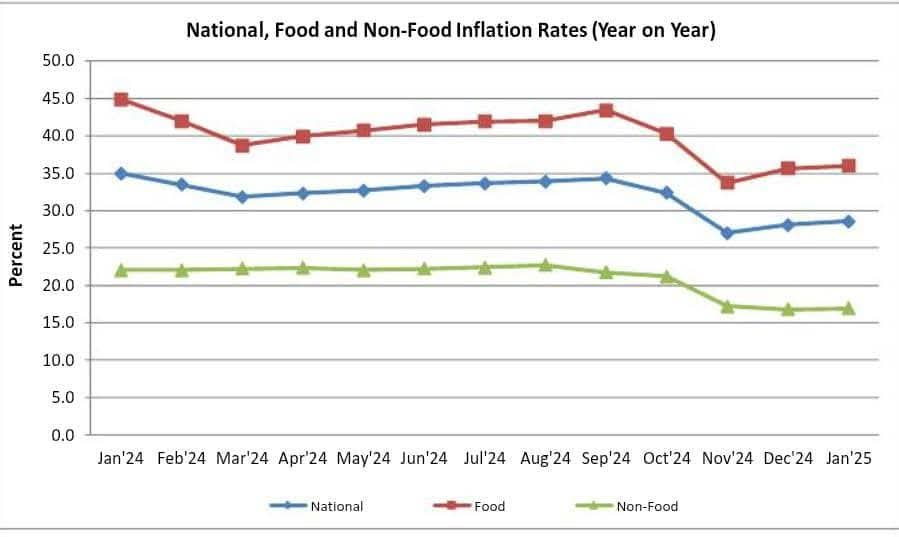

Malawi’s economic landscape continues to be shaped by inflationary pressures, with the latest figures from the National Statistical Office (NSO) revealing a year-on-year headline inflation rate of 28.5 percent for January 2025. This represents an increase from 28.1 percent recorded in December 2024, primarily driven by rising food prices.

According to the NSO January 2025 Consumer Price Indices, food inflation remains the biggest contributor to the surge. It now stands at 36.0 percent, up from 35.6 percent in December. In contrast, non-food inflation remained relatively stable, showing a slight increase from 16.8 percent to 16.9 percent.

This trend underscores the significant role that food costs play in shaping Malawi’s overall inflation. Given that food constitutes a major portion of household expenditures, the rising cost of essential commodities continues to erode the purchasing power of many Malawians, especially those in lower-income brackets.

The persistent increase in food prices can be attributed to several factors:

1) Supply chain disruptions – Poor weather conditions, logistical challenges, and rising transportation costs have affected food production and distribution.

2) Currency depreciation – The weakening of the Malawian kwacha against major currencies has led to higher import costs, particularly for essential agricultural inputs like fertilizer and fuel.

3) Global commodity price volatility – International price fluctuations in staple food items such as maize, wheat, and rice have influenced domestic prices.

4) Seasonal effects – January falls within Malawi’s lean season when food stocks are low, pushing prices upward.

While food inflation surged, non-food inflation remained relatively controlled, increasing marginally to 16.9 percent. This indicates that price pressures in sectors such as housing, utilities, transportation, and clothing have not escalated as rapidly as food costs. However, continued depreciation of the kwacha and potential fuel price hikes could still pose risks in the coming months.

Consequences of high inflation

1) Reduced PURCHASING POWER – As prices rise, households struggle to afford basic necessities, leading to lower standards of living.

2) Increased Cost of Doing Business – Companies face higher operational costs, which may result in price hikes for goods and services.

3) Impact on Savings and Investments – High inflation erodes the value of savings, making it difficult for individuals to plan for the future.

4) Poverty and Inequality – Low-income households are disproportionately affected as food takes up a larger share of their expenditure.

To address these inflationary challenges, a multi-faceted approach is required:

Agricultural Reforms – Boosting local food production through subsidies, irrigation schemes, and improved farming techniques can help stabilize food prices.

Monetary Policies – The Reserve Bank of Malawi (RBM) must adopt measures to stabilize the kwacha and control inflationary pressures.

Diversification of the Economy – Reducing dependency on imported goods and expanding local industries can mitigate external shocks.

Social Protection Programs – Government interventions, such as food relief programs and targeted cash transfers, can cushion vulnerable populations.

The 28.5 percent inflation rate in January 2025 signals ongoing economic difficulties, with food prices being the primary driver. While non-food inflation remains moderate, rising costs of essentials continue to burden Malawian households. Addressing inflation requires comprehensive strategies that enhance food security, stabilize the economy, and protect the most vulnerable citizens from the adverse effects of soaring prices.

What Next for Malawi?

As the country navigates these economic challenges, policymakers must act swiftly to implement long-term solutions that promote price stability, economic resilience, and sustainable development. Failure to do so may see inflationary pressures persist, further straining the livelihoods of ordinary Malawians.