FDH Bank plc says it will soon roll out an Islamic banking window in response to demand for the service in the country.

Islamic banking, also referred to as Islamic finance, is premised on two fundamental principles of Islamic banking which entails sharing of profit and loss and the prohibition of the collection and payment of interest by lenders and investors.

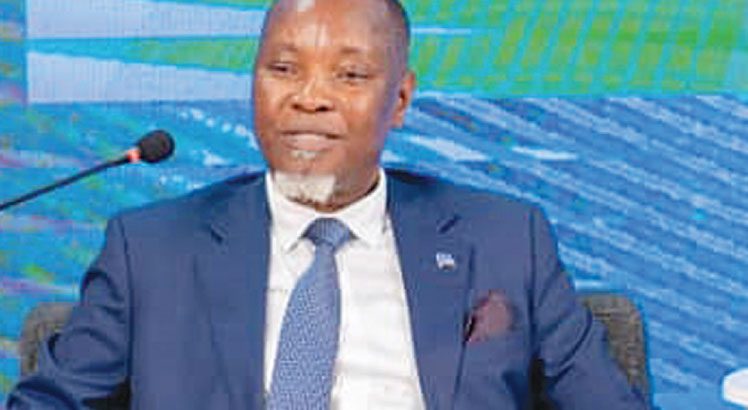

Speaking on the sidelines of an investor meeting in Blantyre on Friday, FDH Bank plc managing director Noel Mkulichi said they want to capture part of the economy which is interested in the financing.

He said: “There is a certain part of people in the economy that wants this kind of financing and we would want to capture that and ensure we service them.

“We have done the concept and engaged the central bank to get an ok to introduce the product.”

Mkulichi said under the window, the Malawi Stock Exchange-listed bank will not charge any interest on the products on offer, but instead there will be a sharing arrangement in terms of profits that will arise.

He said: “This is going to run as a window separate from the conventional banking. Initially, what we intend to do is just offer one or two products and depending on the performance of those products then we will bring the rest of the products under the Islamic banking.”

Malawi Confederation of Chambers of Commerce and Industry president Lekani Katandula described the move as positive, saying if well executed, it could help grow the economy.

“It is good to see different players introducing different products to better serve different market segments,” he said.

On his part, Chamber for Small and Medium Business Association executive secretary James Chiutsi said the window could not have come at a better time than now when the cost of capital is high.

He said: “For years, we have decried high interest rates which have made borrowing from financial institutions very hard.”

But economic statistician Alick Nyasulu, while indicating that aspects of Islamic banking are worthy pursing given the high cost of borrowing, said it is not as easy as it seems.

“One key advantage of Islamic banking is that it connects the real economy and does not operate on speculative investments,” he said.

Elsewhere in Africa, South Africa, Nigeria, Kenya, Senegal, Djibouti, Uganda and Morocco have legal and regulatory frameworks and run Islamic finance products